As of 1:45pm today, May 6, 2025, there were 9,896 apartment condos for sale in the three Lower Mainland boards (GVR, FVREB, CADREB). When we take a look at the snapshot from the end of April, there were 7,117 apartments for sale in Greater Vancouver, 2,483 in the Fraser Valley, and 201 in the Chilliwack area. The last time that GVR had over 7,000 apartment listings was back in July 2012! The Fraser Valley on the other hand, has NEVER had this many apartment condo listings.

Of course, part of the case for the Fraser Valley suburbs is that there has never been the same level of building permits as we’ve seen over the past decade. The result? Prices of apartment condos in the region have been either flat over the past 3 years, with many condo owners still seeing lower values than they had back in 2022.

This is basic supply and demand. With the rise in interest rates over 2022-23, demand was obliterated, while the building permits kept on coming.

As rental rates stabilize or even lower throughout many cities, and an increase in owners facing renewals, the listings are rising, but the demand isn’t keeping up.

Far too many people buy into hype – they see rising prices and feel like they must get in. Intellectually, we know that we should “buy low, sell high”, but emotionally, we all face FOMO.

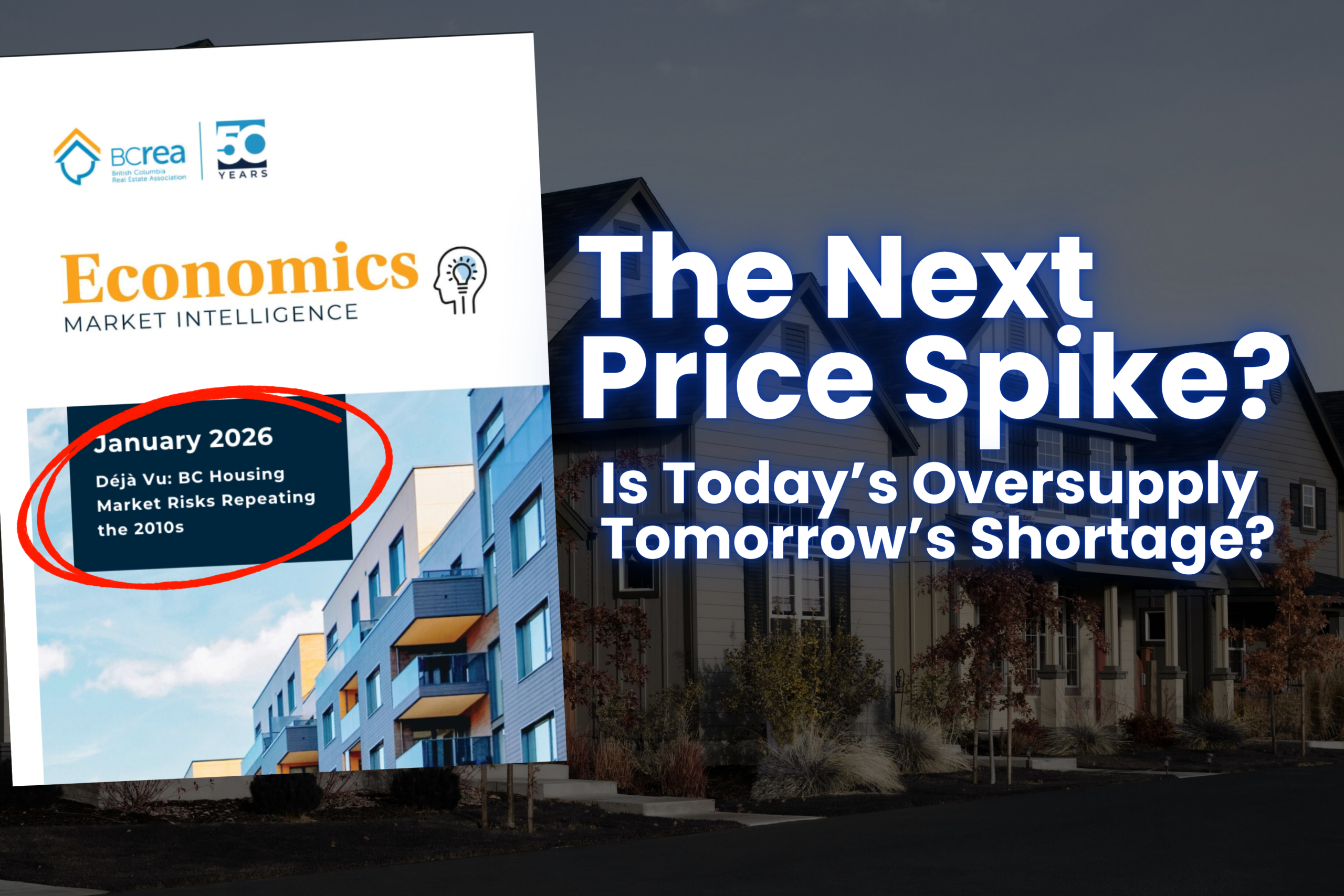

Yet here we are now with more selection than we’ve ever seen, which has led to building permits in 2024 and 2025 falling to their lowest point in a half decade. Now, in this market lull – not at the peak of the market – may be the best time to think about long-term investing.

There is a very real market cycle in the Vancouver real estate market. While the timing depends a fair bit on macro-economics and government intervention, the reality is that the cycle has a cause that has been going on since at least the 1950s:

- Low demand, high supply = low building permits

- Prolonged low building permits with increasing demand = low supply

- Low supply = higher prices

- High prices = increase in building permits, prices eventually outpace affordability, market corrects

- Repeat

Remember, it takes 3-5 years for a developer to buy land and build a midrise, so that’s one reason for the lack of consistency.

The Vancouver benchmark price over the last 20 years shows how this cycle works. 2005-2008 witnessed skyrocketing prices, only to crash in 2008-09. There was a bounce back over the latter half of 2009 and into 2010 because of an over-compensating correction, but then a half-decade long lull. Yet because of the severe lack of development throughout the region during this time, demand continued to pent up. When it exploded, it really exploded. Yet, what goes up, does come down – a bit. We see the rise in 2015-18, then a correction in 2019. There was a bit of a lull again, then an artificial high because of interest rates in 2020-21. After a correction and the cyclical bounce back, we’ve been back at that stagnant market.

Could we be in for another spike soon? I don’t know. I wouldn’t bet all my chips on it for at least another 2 years. Yet, the longer it goes on, if building permits remain stagnant or even decline as a response to the soft market, the sharper the spike will be later. In a word, it may not be the best time to invest before that happens. Yet, because it could be awhile still before a major appreciation jump, investors and condo buyers need to be vigilant. Buy in cities most likely to see appreciation: avoid dangers of over-saturated supply, and where demand will be highest.

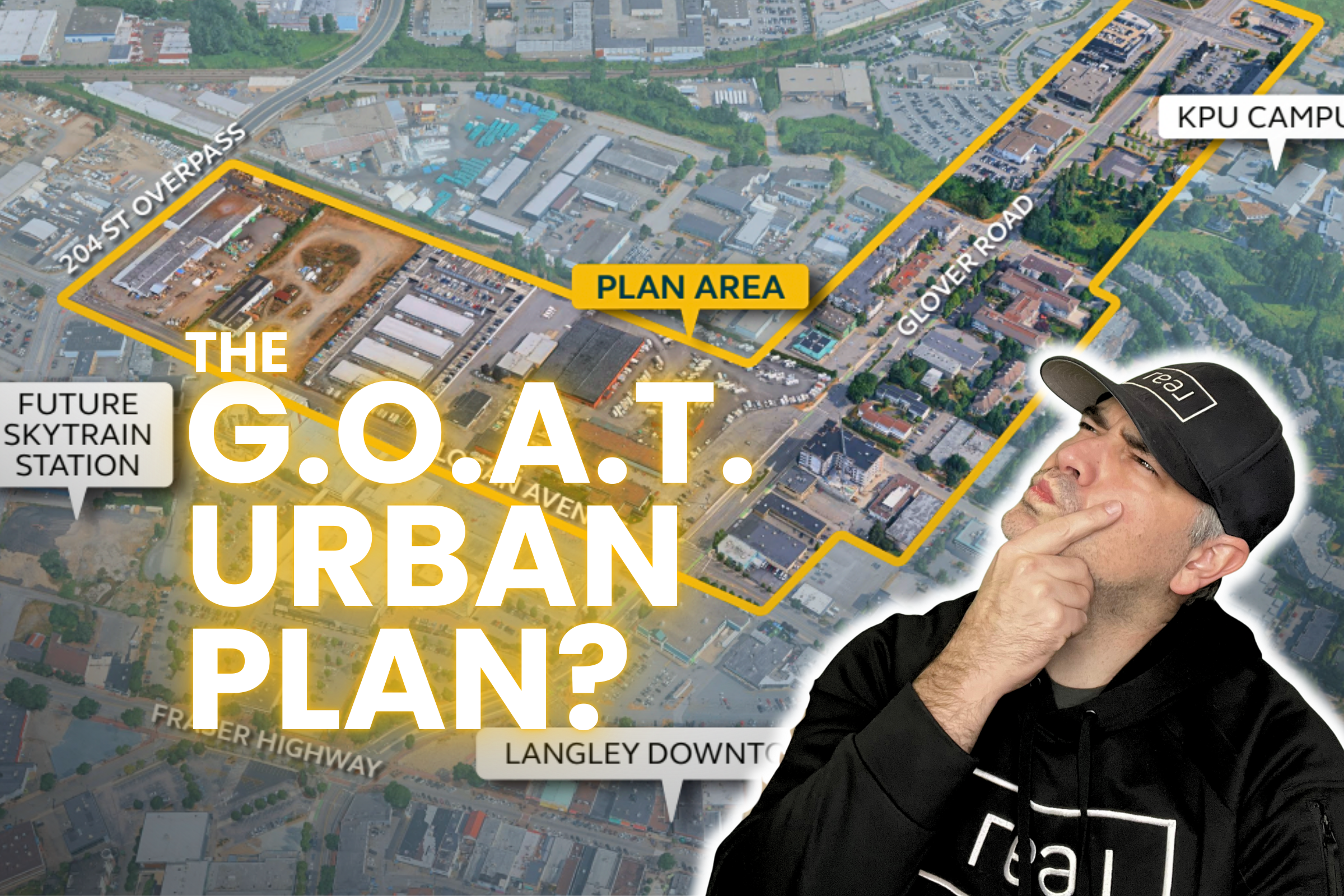

I can’t predict demand. Yet some things are obvious. New rapid transit opportunities, especially through Surrey and Langley, are opening up areas previously dependent on cars for regular commuting. Growing employment opportunities in communities like Abbotsford and Chilliwack provide for a different buyer segment. And, of course, if Vancouver can solve some of its pertinent political and crime issues, the whole region benefits.

I nerded out today and built this chart of the number of condos for sale throughout the region, and broke it up by price. The green sections represent the price points under $500k. A quick glance shows that there are 4 cities where there are a significant number of homes under half a million – although what that money buys you has a wild range.

1. SURREY

The first obvious one is Surrey. As of this first week in May, there are 438 active listings (or with pending contracts) under $500,000 (although this number climbed to 466 by 3:00pm as I write this).

As you can tell from the beautiful pie charts above, the majority of apartments on the market under $500k in Surrey are still under 10 years old. Furthermore, half of the apartments on the market are 2+ bedrooms. As an investor or young homeowner, this is an ideal situation because newer units generally means you don’t have levies or higher strata fees to worry about. Additionally, 2 bedrooms gives you more flexibility and resale value.

2. ABBOTSFORD

The next city that jumps out to me is Abbotsford. This is a far cry from the 2010-2015 era where no developer would even touch the city – it was hit particularly hard during the 2008-09 collapse. Yet confidence is growing in the city as a secondary regional employment hub.

Your money obviously goes farther in Abbotsford than Surrey. Almost 3/4 of homes for sale are at least 2 bedrooms – although there aren’t exactly many “family-friendly” 3 bedroom apartment available. There are also a lot less newer homes. Over 70% of available condo listings in Abbotsford are over 20 years old. This means that investors and home buyers need to pay closer attention to depreciation reports and strata corporation financials. These units can be great purchases, but there are significant differences in how individual stratas have taken care of their buildings. One piece of advice: don’t ever gauge your purchase solely on the strata fee. Sometimes low strata fees, whether in a new or old building, are a sign of poor financial management.

3. CHILLIWACK

Less so than Abbotsford, Chilliwack always surprises me a bit. I lived in Chilliwack after I graduated from university back in 2007 and despite its relative distance from Vancouver, I am always surprised at the amount of new development. While I consider Langley where Burnaby was 20 years go, I think Chilliwack is where Langley was 20 years ago. This means that while there are a handful of apartments being built, the majority of new development is single family homes (but with legal basement suites).

Regardless of all this new single family home development, there is still a healthy supply of apartment condos in Chilliwack. Considering that rents are more or less just as high as in Abbotsford, but at usually lower prices, Chilliwack can be attractive for investors and homeowners alike.

The current Chilliwack condo market shares similarities with Abbotsford, but with a higher proportion of 1 bedrooms and slightly less older apartment buildings.

Personally, I’m partial to Chilliwack because of the natural beauty, access to lakes & parks, and the increasing demand of high income earners. Additionally, Chilliwack has a few really cool cultural things going on that are really rehabilitating some of the rougher parts of town. However, the distance to Vancouver continues to be a bit of a deterrent for some.

4. VANCOUVER

Wait, what? Vancouver? Really? Yes, even though Vancouver has the overwhelmingly highest number of $1m+ apartments, it also still has a good number of sub-$500k units. Of the 2,676… wait, 2,697 (over 20 new listings hit the market since I’ve been writing this), 126 are still under $500,000. That’s more condos than Chilliwack has in total. Of course, your money doesn’t go nearly as far.

The City of Vancouver obviously offers opportunities that are fairly different than the suburbs. On one hand, investors will realize much higher rents and homeowners will have the benefit of being the middle of “it all”. Of course, which the much higher demand of living in one of the most beautiful cities on the planet comes more limitations for buyers.

One thing that my pie charts won’t show is how many leaseholds are in that $0-500k range. Whereas Abbotsford and Chilliwack have 0 leasehold apartments on the market (this changed in the townhome and detached home market) and Surrey only has a few, over 17% of Vancouver’s sub-$500k apartments are leasehold. Lifestyle-wise, there is absolutely nothing wrong with this. But as an investor, you have to understand that with a leasehold you are purchasing the depreciating liability (building) while “renting” the appreciating asset (land).

Regardless of that statistic, over 95% of Vancouver apartment condos on the market today are either studio or 1 bedroom units. On top of that, over 42% are over 40 years old and almost 70% are over 20 years old. Many of these condo buildings are struggling to meet the new BC provincial requirements that close the loophole on stratas who have waived depreciation reports since the original implementation in 2011.

CONCLUSION

Obviously the number of available listings in a certain price range is not the be-all end all for buyers, whether owner-occupying or investing. However, I wanted to provide a sense of where the last vestiges of relatively affordable home ownership is in the region. If you, or anyone you know, would like a list of properties under $500,000 in any particular area, with specific criteria, shoot me an email at [email protected]. Whether you are looking for a home to live in or you are an investor, I take a look at your specific circumstances and advise with ethical empathy.